February 5, 2014

2/5: Millions of Americans Having Financial Difficulty

NBC News/Marist National Poll

Millions of Americans are having trouble making ends meet. Close to four in ten adults nationally — 37% — describe the state of their household finances as either weak — 17% — or somewhat weak — 20%. That 17% of adults translates into approximately 41 million Americans who are struggling to get by. This compares with more than six in ten adults — 63% — who say their financial situation is either strong — 24% — or somewhat strong — 39%.

Click Here for Complete February 5, 2014 USA NBC News/Marist Poll Release and Tables

Click Here for Complete February 5, 2014 USA NBC News/Marist Poll Release and Tables

“Despite the fact that many Americans are still struggling to make ends meet, optimism about their personal finances in the coming year is the highest it has been in five years,” says Dr. Lee M. Miringoff, Director of The Marist College Institute for Public Opinion.

There are demographic differences. Not surprisingly, 30% of adults who earn less than $50,000 annually describe their finances as weak while only 5% of those who earn more say the same. Americans 45 to 59 years old, who may still be supporting their children while at the same time caring for parents, are more likely than other age groups to say their money situation is faltering. One in five members of this generation — 20% — says their household finances are weak.

Looking at the amount of debt Americans have, close to one in ten residents — 9% — reports the sum of money they owe overwhelms them. To put this proportion into perspective, this adds up to approximately 22 million U.S. residents who say they are overwhelmed by the money they owe. An additional 35% of Americans are able to manage their debt, but they are worried about what they owe. A majority of residents — 55% — believes their debt is under control.

Again, income is key. Americans who earn less than $50,000 a year are four times more likely than those who make more to be overwhelmed by their level of debt. 16% of those with an annual salary less than $50,000 experience significant financial stress compared with only 4% who earn more.

Table: State of Household Finances

Table: How Would You Describe Your Amount of Debt?

Plurality of Americans Saving Less Money

43% of adults say, compared with last year, they are saving less money. 36% are putting more money in the bank, and more than one in five — 21% — says they are saving about the same. There are income differences. A majority of those who earn less than $50,000 a year — 52% — are saving less money. This compares with 37% of those who make $50,000 or more.

Table: Are You Saving More or Less Money?

Americans Daily Spending Habits… Many Cutting Back

More than six in ten residents — 63% — say, compared with last year, they are eating out less. About one in four — 24% — has not changed their dining habits, and 13% are eating out more.

Have Americans postponed a major life event, like getting married, having a baby, or retiring, to save money? While 82% have not, 18% of residents or about 43 million adults say they have put off a major event in their life for financial reasons. Of note, Americans between the ages of 45 and 59 are slightly more likely than any other age group to say they have delayed a big event for financial reasons. 23% of Americans in this age group report this to be true.

More than one-third of Americans — 36% — have not purchased a big ticket item like a television or car due to affordability. This means that more than 86 million adults have changed their purchasing plans. 64% of residents, though, have not put off a major purchase.

Not surprisingly, income matters. More than four in ten residents who have less than $50,000 coming in each year — 43% — have delayed buying a big ticket item. This compares with 29% of Americans who earn more. Households with children — 40% — are more likely than those who do not have children — 33% — to have had to forego an expensive item.

Have Americans cancelled their cable or cell phone service because of their financial situation? While 73% have not, 27% of Americans have. Looking at income, 33% of those with an annual salary under $50,000 have cut back on these types of services. This compares with 22% of those who make more money. Again, Americans age 45 to 59 — 37% — are more likely than other age groups to have cut back on services like cable television.

More than one in ten Americans — 12% — or approximately 29 million adults need a new winter coat while 35% have a new one this season. A majority — 53% — is wearing a worn coat which is still warm. Residents who earn less than $50,000 — 17% — are more than twice as likely to be in need of a new coat than those who make more money — 8%.

Are Americans filling their refrigerators? More than seven in ten — 72% — have the same amount of food in their fridge as they did last year. Nine percent has more, and a notable 19% have less food in their refrigerator.

Again, income makes a difference. More than one in four Americans who earn less than $50,000 — 27% — has less food in their refrigerator compared with 12% with a larger annual salary.

Table: Have You Eaten Out More or Less Compared with Last Year?

Table: Have You Postponed a Major Life Event for Financial Reasons?

Table: Have You Not Purchased a Big Ticket Item for Financial Reasons?

Table: Have You Cancelled Services for Financial Reasons?

Table: Do You Need a New Winter Coat?

Table: Is There More or Less Food in Your Refrigerator Compared with Last Year?

Optimism about Family Finances Grows

While a majority of Americans — 54% — believes their family finances will be status quo in the coming year, 35% think their financial situation will get better. 11% say they will get worse. There has been an increase in the proportion of Americans who think their financial picture will brighten. In Marist’s July survey, 29% of residents thought their money matters would get better while 19% believed they would get worse, and a majority — 52% — said they would stay about the same.

Regardless of their current financial situation, close to seven in ten Americans — 69% — are optimistic about how things are going in their lives. Seven percent are pessimistic, and 24% are uncertain.

Money is more likely to buy optimism. Nearly three in four Americans with higher incomes — 74% — are positive about their lives. This compares with 66% of those who earn less than $50,000 a year. Also of note are Americans 45 to 59 years old who are more likely than other age groups to describe their own lives in the coming year as uncertain — 33%.

Table: Your Personal Family Finances – Better, Worse, or the Same?

Table: Your Personal Family Finances – Better, Worse, or the Same? (Over Time)

Table: Are You Optimistic about Your Life?

Table: Are You Optimistic about Your Life?

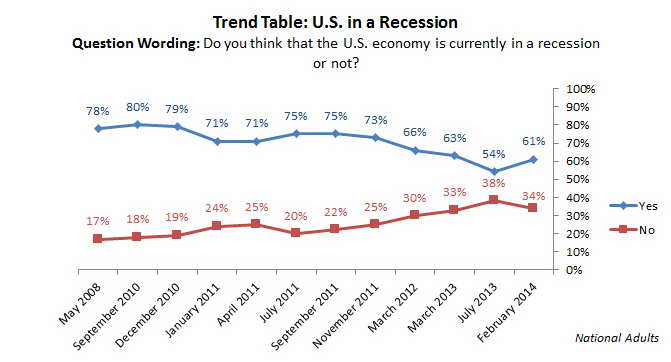

More than Six in Ten Think Nation is still in a Recession

While the United States is officially no longer in a recession, 61% of Americans still describe it that way. 34%, however, do not think the country is in a recession, and 4% are unsure. While more residents think the country is in a recession than did in July, the proportion of those who believe this to be the case is about what it was in March 2013. At that time, 63% of Americans said the country was in a recession. When Marist last reported this question in July, 54% said the U.S. was in a recession, 38% reported it was not, and 8% were unsure.

Table: U.S. in a Recession Over Time

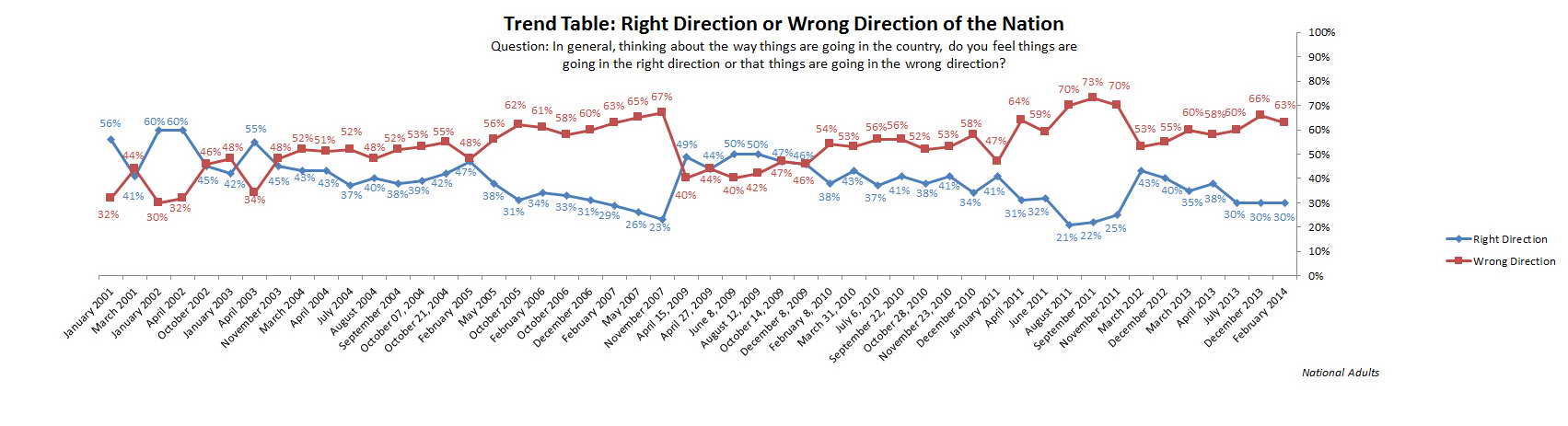

Nation Needs a New Course?

63% of adults nationally think the country is moving in the wrong direction. Three in ten — 30% — say it is moving in the right one, and 8% are unsure. There has been little change on this question since Marist last reported it in December. At that time, 66% of residents believed the nation was off course, 30% thought it was on track, and 4% were unsure.

Table: Right or Wrong Direction of the Country

Table: Right or Wrong Direction of the Country (Over Time)